Entry level salaries are a lesson in irony. You’re earning next to nothing, but you need to be saving and you’re probably eager to set up a place to call your own.

Entry level salaries are a lesson in irony. You’re earning next to nothing, but you need to be saving and you’re probably eager to set up a place to call your own.

When I started working full time in 2006 I earned $33k a year before taxes. That money went about as far then as it does now, but I still managed to save a little bit each month. $25 here, $50 there, and it started to add up. I got hooked on savings and wanted to watch my savings account grow. My salary wasn’t about to change anytime soon, so I looked for ways to cut expenses. Below are my 20 best tips for how to save money on an entry level salary.

20 easy things I did to save $$$

- I didn’t have TV service. I didn’t even miss it and without it, I wasn’t even aware of all the cool things I wasn’t buying!

- I barely furnished my apartment. With the exception of one sofa, everything in my apartment came from my parents or my own bedroom. My kitchen table was a card table, my nightstand a short bookshelf. All my chairs folded. It wasn’t magazine-worthy, but it did save me a fortune.

- I bought very few video games. :( SO SAD. And ironic, considering my job was developing video games. When I did buy a game, it was usually a Nintendo DS game from GameStop pre-owned selection for $10-$20.

- I didn’t subscribe to anything. No magazines or newspapers – the Internet’s got more than you’ll ever read, anyway.

- I didn’t adopt a pet. Unless you already have one, consider growing your salary to a more comfortable level before adopting. A pet may also limit your apartment options and/or increase your deposit and monthly rent, and being mobile in your early years is helpful in some fields.

- I didn’t buy any books. I did, however, check out numerous books from the library a mile away. Added bonus: I didn’t have to move them (twice!) when I moved (twice!) in 2008 (twice!).

- I cooked everything at home/brought lunches. I don’t think I ate out more than a few times in my first year working. A meal out seems to run me about $8-15, but that much bought me several days worth of meals in a grocery store. Conservative savings estimate: $5 x 250 work days in a year x 7 years = $8750.

- I didn’t buy much new clothing. I dressed fairly nicely in college and was able to wear the same clothing to my first job, which had a casual dress code.

- I discovered Sunday morning movie dates. Jim and I would meet at a theater halfway between our homes to see movies for $5 on Sunday mornings. It’s the same freakin’ movie for 1/3rd the cost of a Friday night showing. We still go see movies on Sunday mornings.

- I bought few electronics: I did treat myself to an iPod so I wouldn’t have to lug my Discman and giant bag of CDs into the office each day.

- I dated cheaply. Dates were walks, home cooked meals for two, surfing the web together, sitting and talking.

- I never bought soda/juice. Once I saw how much soda and juice cost, I quit drinking them. I probably saved several hundred dollars by going water-only (and probably avoided a few calories, cavities, and kidney stones).

- I shopped sales. I never had the patience or time for coupons, but I did use sales to stock up on things I was going to buy anyway like meat and toilet paper. BTW, buying crap on sale that you weren’t going to buy otherwise isn’t a deal.

- I didn’t socialize much. Drinks, movies, GameWorks, dinners – socializing should just be renamed to “spending”. My introvert brain didn’t mind not doing this stuff. :)

- I had cheap hobbies. Painting in Photoshop, sewing, walking, and reading were all dirt cheap ways to spend my evenings and weekends.

- I moved to an apartment a few miles from my job. I went from spending $80/week on gasoline to filling up maybe once every 3 weeks. This also extended the time between car maintenance.

- I didn’t vacation. Sad but true. I didn’t take any time off until I was nearly 2 years into my job, and even then we saved money vacationing in Michigan (a few hours away by car) in the off season (everything was boarded up, it was cool!).

- I bought store-brand everything. Most of it is just as good as the name brands I was raised with.

- Leaned on Mom and Dad. They covered dentist appointments, let me do laundry (for free!), and occasionally filled my car with gasoline. Visiting Mom and Dad has benefits. :)

- I set up an automatic money transfer. By automating savings, I never even had the chance to see it pile up in my checking account. It just magically appeared in my savings, and I became very motivated to help my savings grow larger.

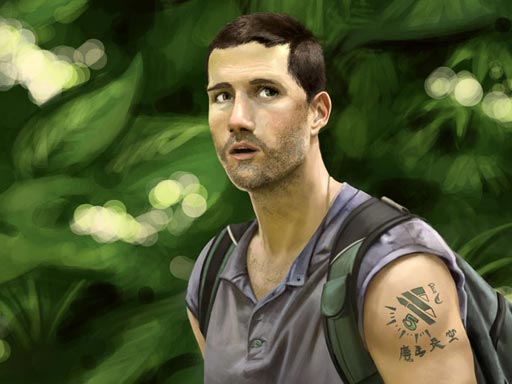

My frugal hobby #1: Painting! As a former art student, I already had a decent computer, Wacom tablet, and Photoshop. (Ironically, TV show characters remain a favorite subject, despite my lack of TV :D )

My frugal hobby #2: Sewing plush. I designed and created these little dudes my first year working full time (they are basically a part of our family now) .

If you’re just starting out, see what you can do without. Your list will be different than mine, and that’s okay.

I refused to cut back on

- Meat. I must eat meat. I don’t know how people live on noodles. Cutting from nutrition is like, a last resort option in my opinion.

- Renter’s Insurance. Nothing bad ever happened, but renter’s insurance was so cheap (like $100/year) and the peace of mind was good to have.

- Quality toiletries, like good razors and deodorant. Some things just have to work.

- Internet: lol wut, give up the Internet?

Your 20s are the best time to start saving, so don’t let a piddly salary get in the way of that. (The next best time to start saving is right now.)

Also, remember that saving money doesn’t do you much good if you just turn around and spend it on something else. Move the money to a dedicated savings account (my favorite is my Capital One 360 savings account, formerly ING Direct – totally free, easy to use).

Last and Most Important Step

Once you have some savings, don’t let yourself spend it frivolously!